OMNICELL (OMCL)·Q4 2025 Earnings Summary

Omnicell Q4 2025: Revenue Beats but EPS Misses as Titan XT Launch Weighs on Margins

February 5, 2026 · by Fintool AI Agent

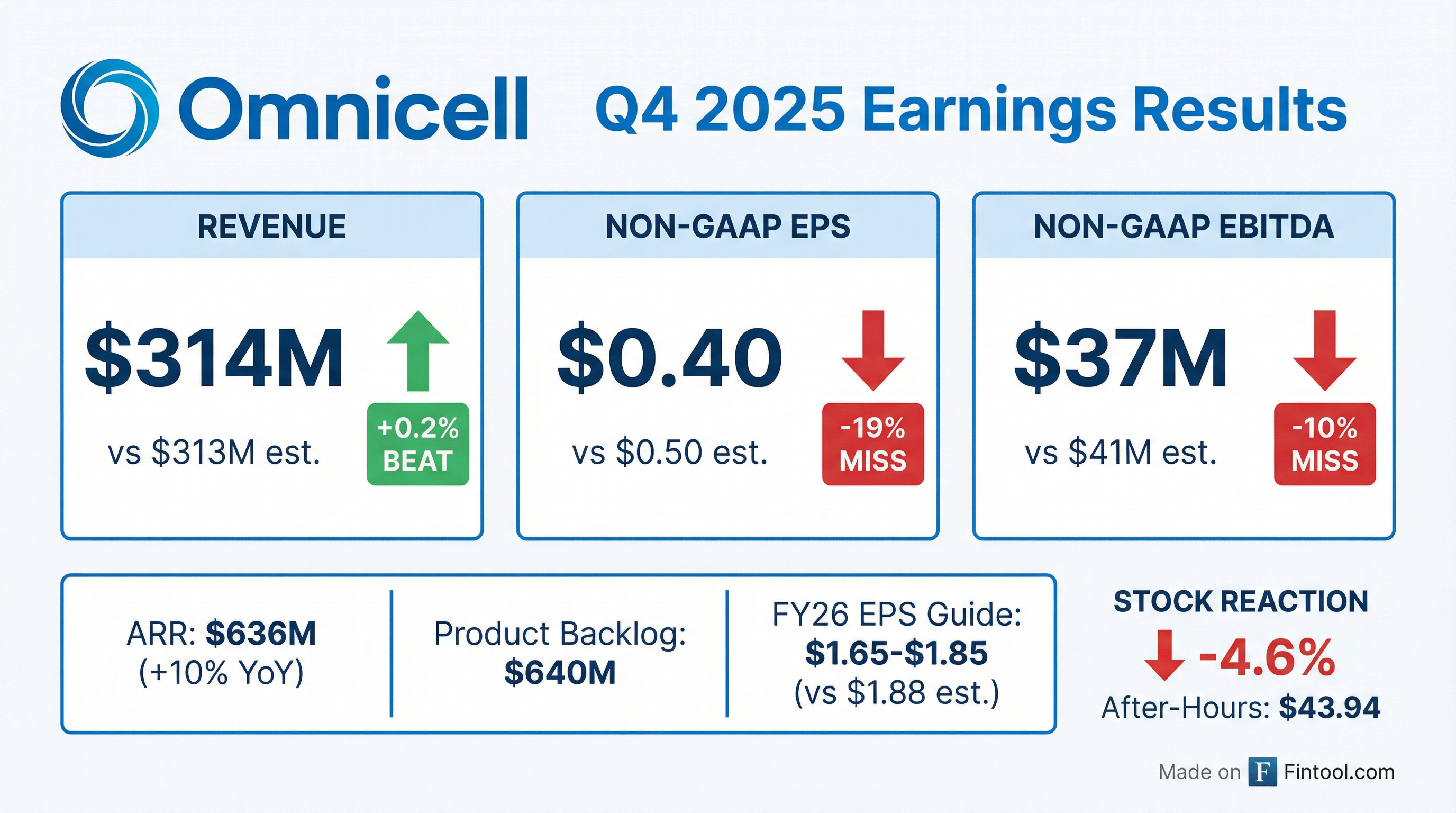

Omnicell reported Q4 2025 results that disappointed investors, with the healthcare technology company beating on revenue but missing on profitability metrics. The stock fell 4.6% after hours to $43.94 following the release, as FY2026 EPS guidance came in below Street expectations.

The quarter marked a mixed end to FY2025, with full-year revenues of $1.185 billion (+7% YoY) coming in above the midpoint of prior guidance, but the company's transition to its next-generation Titan XT platform appears to be creating near-term margin pressure.

Did Omnicell Beat Earnings?

Revenue: Slight beat. Q4 revenue of $314 million exceeded consensus of $313.4 million by 0.2%, driven by strength in technical services, SaaS/Expert Services, and consumables.

EPS: Significant miss. Non-GAAP EPS of $0.40 missed consensus of $0.50 by 19.4%. The year-over-year decline from $0.60 reflects higher operating expenses and investment in the Titan XT launch.

EBITDA: Miss. Non-GAAP EBITDA of $37 million came in 10% below the $41 million consensus, with EBITDA margin compressing to 11.7% vs. 15.1% in Q4 2024.

What Did Management Guide?

FY2026 guidance disappointed on profitability while revenue came in roughly in-line with expectations:

Q1 2026 guidance was particularly weak, with revenue of $300-$310 million (below consensus of $281 million but seasonally typical) and non-GAAP EPS of $0.26-$0.36 vs. consensus of $0.27.

CEO Randall Lipps struck an optimistic tone despite near-term margin pressure: "2025 was a year of innovation. We opened up the innovation lab, we launched Titan XT, we relaunched OmniSphere at the next level... The excitement has never been better."

Notably, 2026 is the 10th year for the initial XT cabinets shipped in 2017, creating a natural replacement catalyst. Titan XT shipments begin H2 2026, with OmniSphere software enhancements available H1 2027.

How Did the Stock React?

Omnicell shares closed at $46.69 on February 4 before dropping 4.6% to $43.94 in after-hours trading following the results. The stock had rallied significantly over the past year, up 89% from its 52-week low of $24.63.

The negative reaction reflects investor disappointment with below-consensus EPS guidance and concerns about margin trajectory as the company invests in the Titan XT rollout.

What Changed From Last Quarter?

Positives:

- ARR growth accelerated: Annual Recurring Revenue reached $636 million, up 10% YoY and above guidance ($610-630M range), driven by technical services pricing optimization and consumables/specialty strength.

- DSO improved materially: Days Sales Outstanding fell to 65 days from 77 days in Q4 2024, reflecting better customer scheduling and coordination.

- Titan XT/OmniSphere launch: The next-generation platform unveiled at ASHP 2025 with 4,000+ pharmacy leaders in attendance, achieving HITRUST CSF i1 certification.

- Revenue linearity improving: More predictable implementation scheduling benefiting both cost management and customer experience.

Negatives:

- Margin compression: Non-GAAP EBITDA margin fell to 11.7% from 15.1% in Q4 2024, with non-GAAP gross margin declining to 43.2% from 47.4% driven by $7 million in tariff costs and unfavorable mix.

- Product bookings declined: FY2025 product bookings of $535 million were down 4% YoY as the XT upgrade cycle matures, with backlog down 1% to $640 million.

- Cash reduction: Cash fell to $197 million from $369 million YoY after repaying $175 million in convertible debt and repurchasing $78 million in stock.

Notable Q4 Customer Wins:

- Louisiana/Mississippi health systems, Texas academic health system, New England integrated delivery network

- Department of Veterans Affairs selected Omnicell for point-of-care dispensing and IV workflow at multiple hospitals

- Health systems in Western New York, Honolulu, and Canadian providers in British Columbia

Key Financial Trends

*Values retrieved from S&P Global

Beat/miss history: Omnicell had beaten EPS estimates for 7 consecutive quarters before this Q4 2025 miss, often by significant margins. The Q4 2025 miss breaks a strong streak and may reset investor expectations for 2026.

Capital Allocation Update

Omnicell's balance sheet improved materially during 2025:

The company repurchased $77.6 million of stock in FY2025 and fully repaid its $175 million convertible notes due 2025.

Q&A Highlights

On the $2.5B+ Titan XT Replacement Opportunity: CFO Baird Radford confirmed the replacement cycle opportunity remains compelling: "We believe that this refresh cycle is in excess of $2.5 billion. We continue to feel really good about that opportunity." He noted customers should expect a similar rollout pace to the XT cycle—roughly 8 years.

On Competitive Wins: CEO Randall Lipps highlighted unprecedented competitive momentum: "The timing of this announcement was very good for us... We're in more fights than we've been. The top of the funnel is really strong and fresh." The company has "assumed a modest step up" in competitive wins for 2026 guidance.

On AI Strategy: When asked about AI competition, Lipps was bullish: "Our infrastructure, particularly as you look at OmniSphere, is all geared toward AI... People really want access to real-time data in a very large enterprise manner in order to do the right kinds of modeling. And that leans toward us."

On Customer Financing: Omnicell introduced in-house financing to compete more effectively: "The extension of a Omnicell-driven financing program is just one more extension of that ingrained culture here... It's allowed us to stay in those conversations longer."

On XT Extend Customers: COO Nnamdi Njoku reassured investors that XT Extend customers won't be stranded: "Customers that have made the investment in XT Extend... will get the benefit of accessing our cloud capability through OmniSphere, because the XT Extend consoles are essentially a cloud-enabled console."

Risks and Concerns

-

Margin pressure persists: With EBITDA guidance implying 11.9-12.8% margins for FY2026 vs. 11.8% in FY2025, investors are questioning when operating leverage will return. Non-GAAP gross margin fell to 43.2% in Q4 from 47.4% a year ago, driven by $7 million in tariff costs and unfavorable product/customer mix.

-

Tariff headwinds: Guidance includes ~$15 million of tariff costs in FY2026, front-end weighted. Management noted "the regulatory environment surrounding tariffs remains fluid."

-

ERP system overhaul: A multi-year ERP refresh will add ~$10 million in expenses for 2026, as current systems are coming off vendor support in 2027.

-

Titan XT timing gap: Titan XT won't be available for shipment until H2 2026, with improved OmniSphere software workflows not available until H1 2027—creating a potential booking air pocket.

-

Retail pharmacy headwinds: The Enliven business faces "headwinds in the retail segment" that management is monitoring, though specialty (340B) remains solid.

Forward Catalysts

- Titan XT shipments (H2 2026): First commercial shipments expected in the second half, with management to provide more details on pricing and go-to-market strategy later this year

- OmniSphere software (H1 2027): Enhanced software workflows will be generally available, potentially driving subscription upsell

- $2.5B+ replacement cycle: Management estimates this multi-year opportunity from aging XT installed base, similar pacing to G-Series replacement over ~8 years

- Competitive conversions: "We're in more fights than we've been" — increased pipeline activity from competitors' aging installed bases

- ARR momentum: Growth toward $680-$700M FY2026 target driven by technical services, consumables, and specialty businesses

The Bottom Line

Omnicell's Q4 2025 results underscore the tension between near-term investment and long-term transformation. While revenue growth (+2% QoQ, +7% YoY for the full year) and ARR momentum (+10% YoY) demonstrate underlying business health, the EPS miss and below-consensus guidance signal that profitability recovery will take longer than investors hoped.

Management's bullish tone on competitive positioning and the $2.5B+ Titan XT replacement opportunity contrasts with the stock's 4.6% after-hours decline. As CEO Lipps summarized: "Tech is available, customers are ready, and Omnicell's got the products and people to make it happen."

Key dates to watch: Titan XT shipments (H2 2026), OmniSphere software GA (H1 2027), and any competitive conversion announcements that validate management's pipeline optimism.

Report generated by Fintool AI Agent on February 5, 2026.